Last Modified:

- About

- About the Program

- Program Partners

- About Food Safety

- Eligibility

- Am I Eligible?

- Funding Categories

- List of Eligible Activities

- List of Ineligible Activities

- FAQ

- Application Process

- How to Make a Claim

- Training

- Industry Training Courses

- Online HACCP Fundamentals Course

- Recognized Certifications and Professionals

- Post-Farm Recognized Certifications and Professionals

- Accredited Food Safety Professionals

- Resources

- Covid-19 Resources

- Safe Food for Canadians Regulations (SFCR)

- Download the Program Guide

- Food Safety Software

- Useful Documents and Links

- Small Business Resource

- BC Industry Councils

- AgriAssurance: Small & Medium-Sized Enterprise Component: Applicant Guide

- Industry Events

- Contact

- Program Contacts

- FAQ

- My Profile

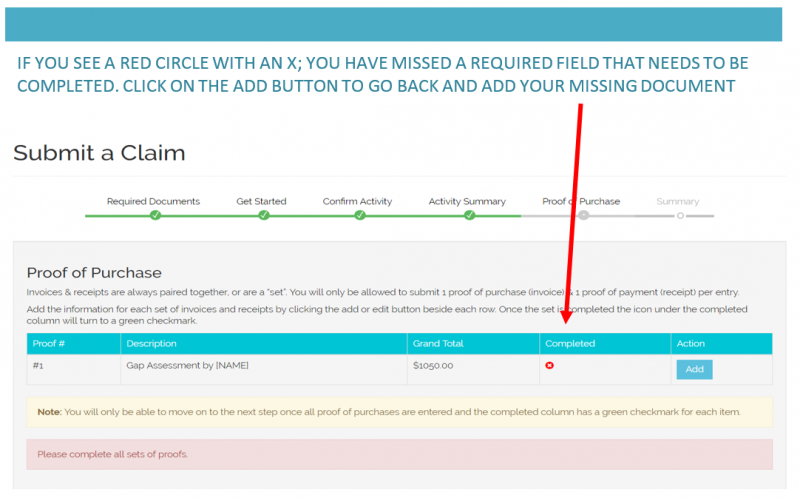

How to Make a Claim

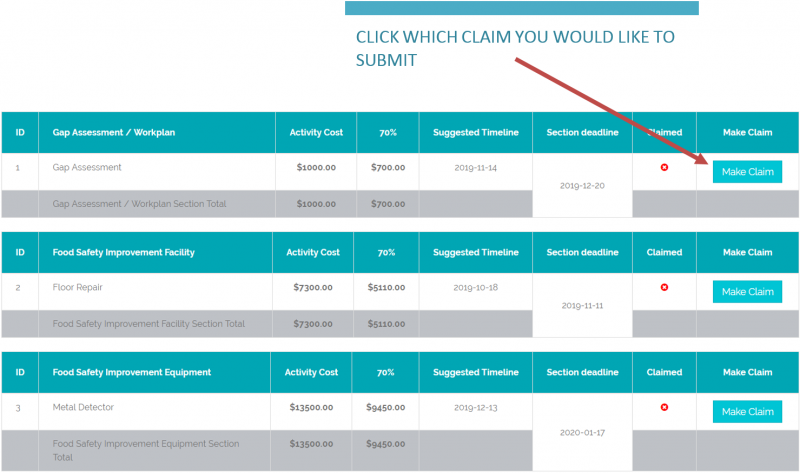

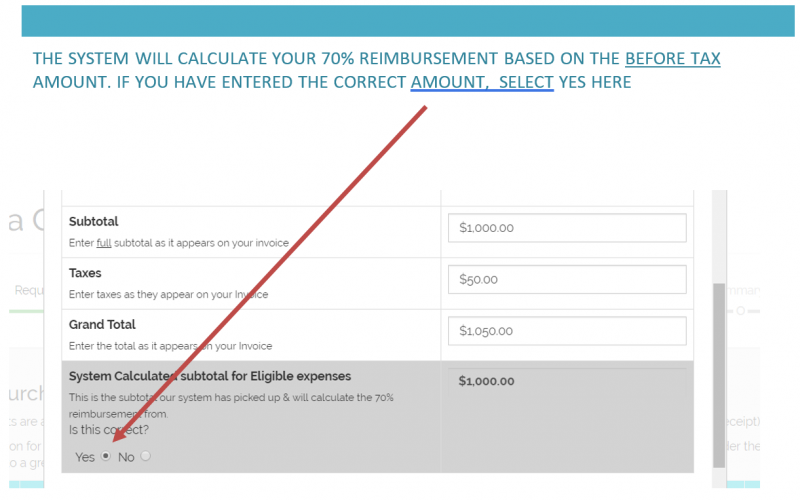

The On-Farm/Post-Farm Food Safety Program is a cost-sharing initiative that will reimburse 70% of food safety activities for eligible food and beverage manufacturers and farm facilities. Participants will assume the full cost of an eligible activity as approved in your program Workplan, and then seek reimbursement from the program, via a claim submission, for their expense. All reimbursements are paid via cheque. As documented in program contracts, you must submit your claims before the set deadlines; otherwise the claim will not be reimbursed by the program. All claims are made online through your ‘My profile’.

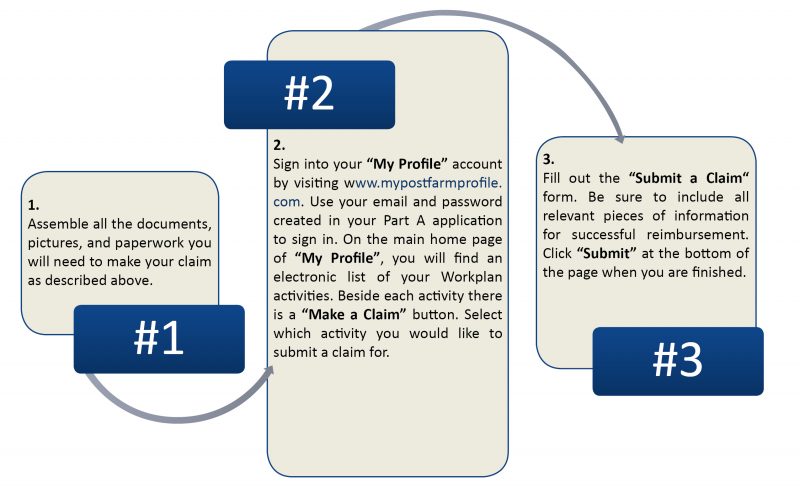

How to Make a Claim

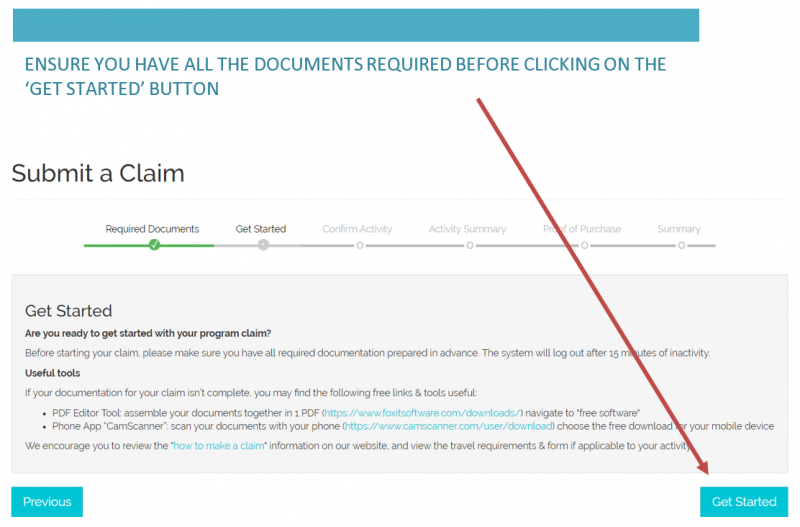

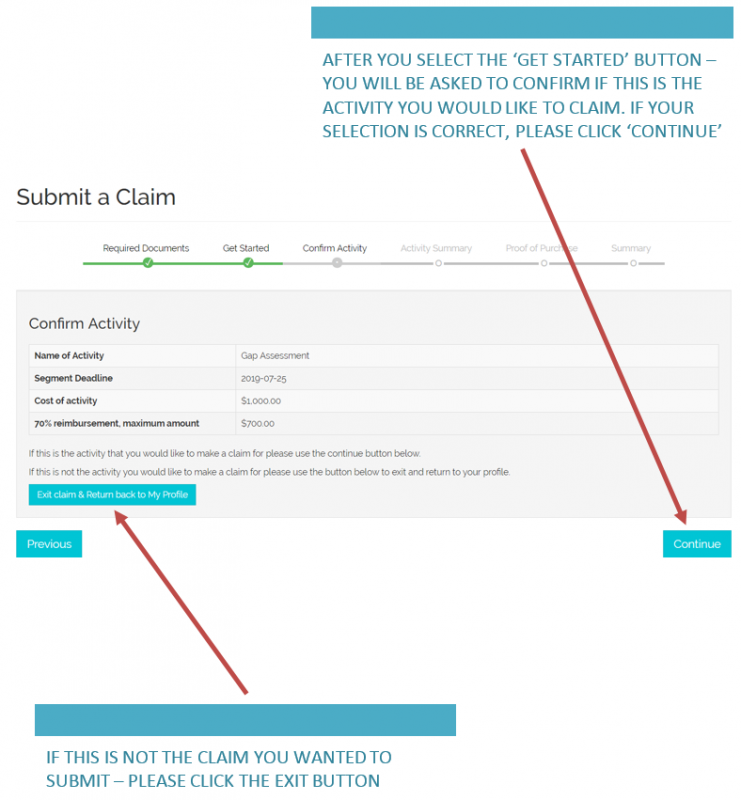

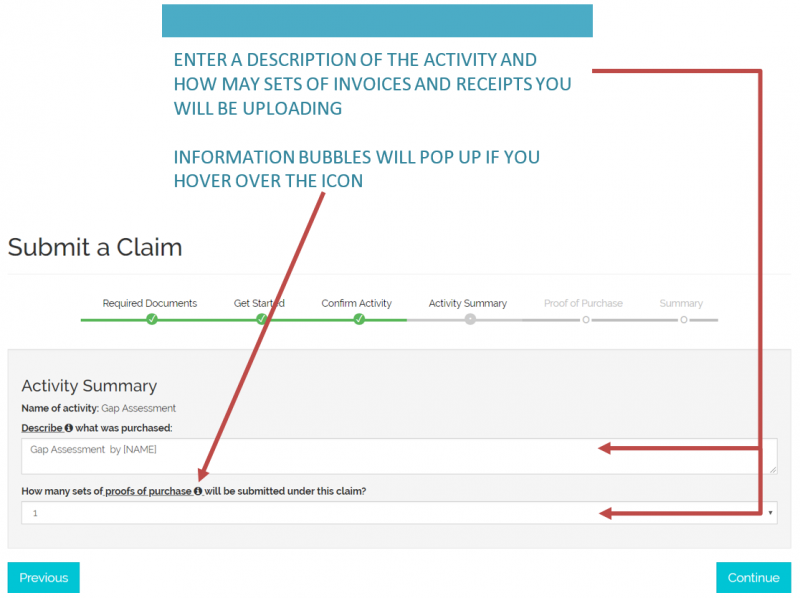

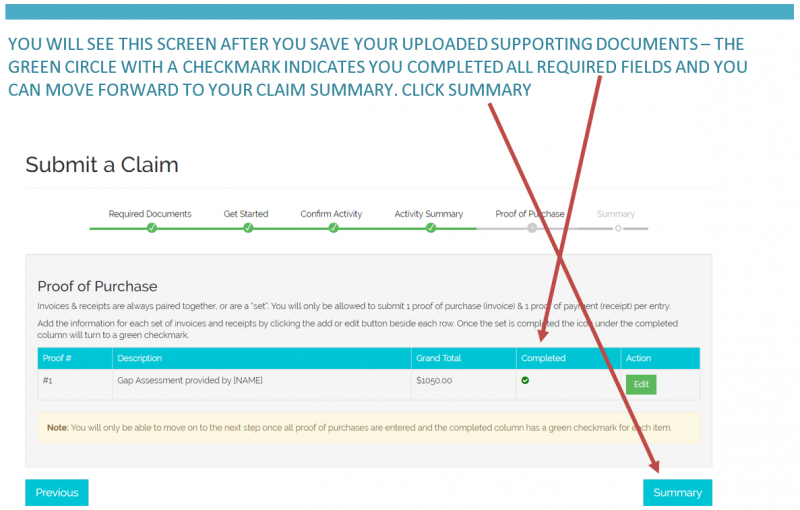

Submitting a claim is easy! Just follow the 3-step process below:

When your claim has been reviewed by the Registrar, you will get an email notification letting you know if your claim was approved or declined. Once approved, the claim will be automatically sent to our Finance Manager for payment via cheque. You should expect your cheque in the mail within 4-6 weeks after the expense has been approved. In high volume times, it may take 6-8 weeks.

Monitoring of Activities

It’s our goal to help you succeed! Throughout the On-Farm and Post-Farm Food Safety Programs, we will regularly monitor all program participants to ensure they are staying on track with their Workplans. As part of the monitoring process, you may be asked to show the progress that you’ve made on activities that may not be fully complete. You will receive a monthly email reminding you to submit your claim and a 2-week notification prior to your section deadline if you haven’t submitted a claim for your activity.

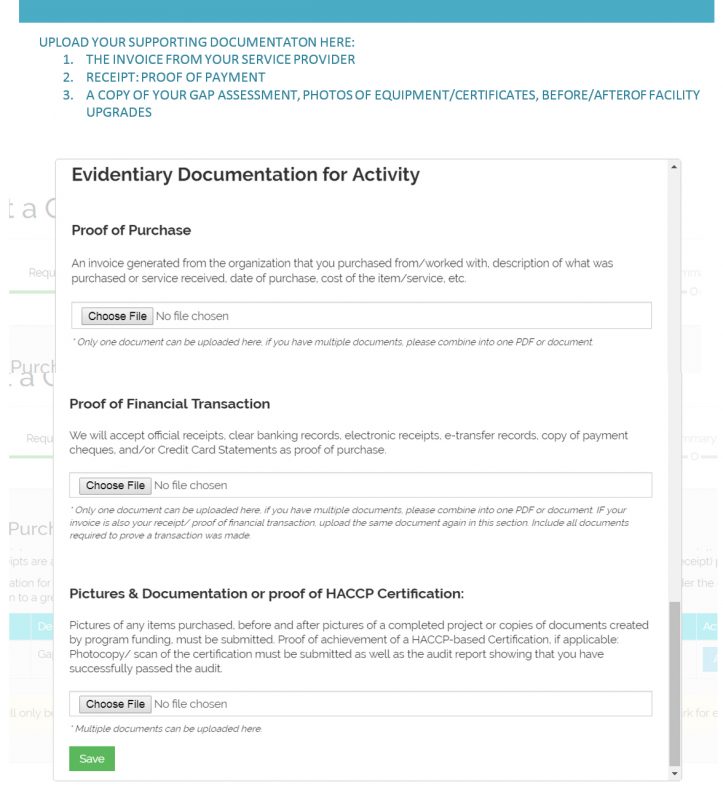

To make a claim, you will need to provide the following documentation:

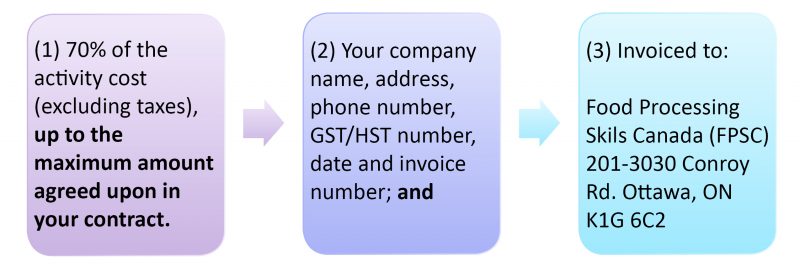

To receive reimbursement, your invoice to Food Processing Skills Canada must include:

Examples:

- Exact Cost: Your activity cost is $1,000 reimbursed at 70% – you will invoice FPSC for $700;

- Under Cost: Your estimated workplan quote is $2,000 reimbursed at 70% – your activity only ended up costing $1,800, you will invoice the FPSC for $1,260;

- Over Cost: Your estimated workplan quote is $2,500 reimbursed at 70% ($1,750) – your activity ended up costing more than was approved by the project workplan, i.e. $3,000. You will invoice FPSC for $1,750; the maximum amount approved on your workplan.

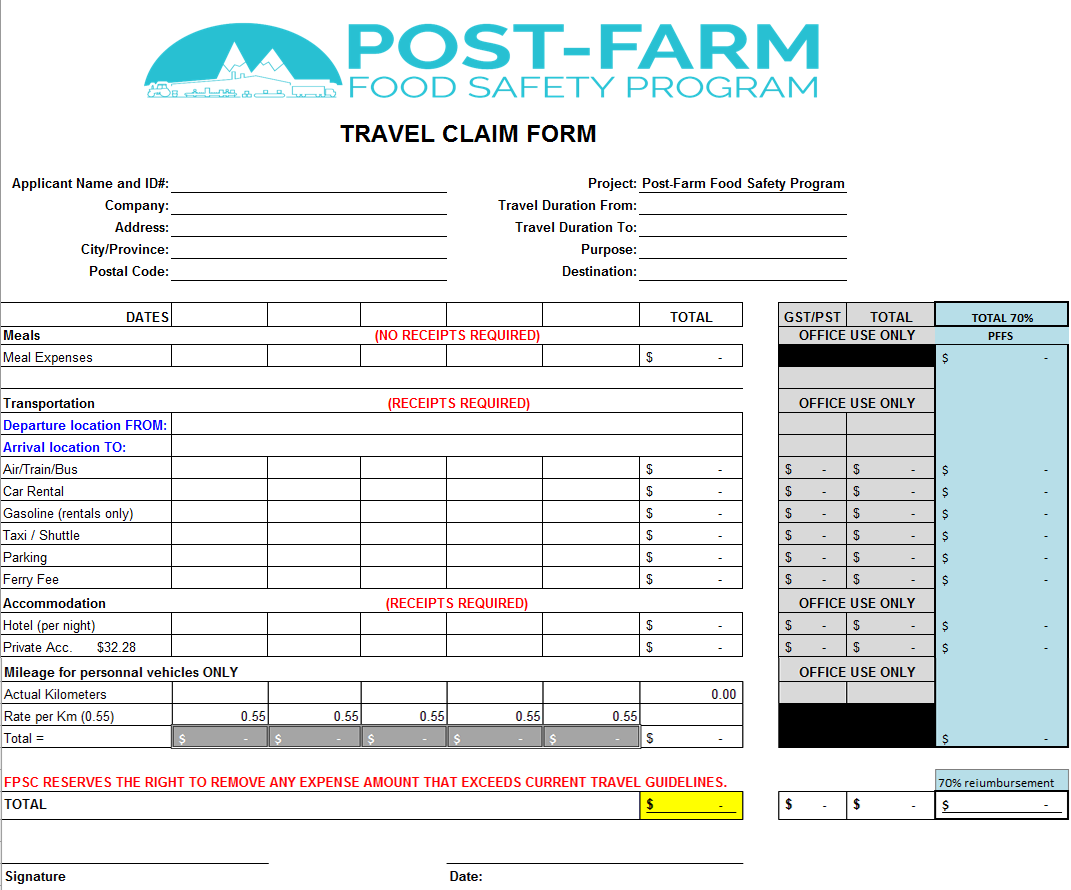

Travel Expenses

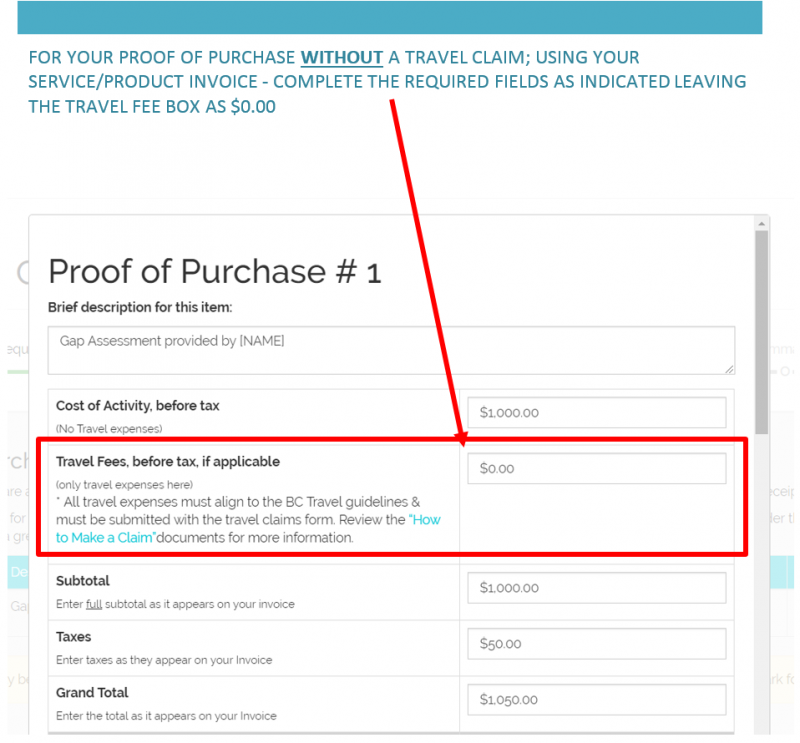

The travel expense form is to allow you to claim possible travel fees charged by your Certifying Body (CB) or Accredited Food Safety Professional (AFSP) for Audits/GAP Assessments. Please note that you as the claimant are responsible to complete the travel claim form and collect receipts from your service provider.

Meal/Per Diem Allowances

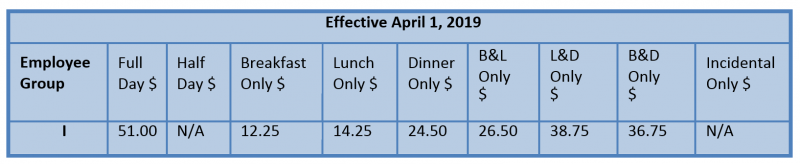

- Meal/per diem reimbursement when travelling on Employer’s business will be in accordance with Treasury Board Orders and Directives at the following rates:

- Where travel is for a partial day, only meals that are applicable to that portion of the day spent on travel status are claimed.

- Where a meal is provided without charge or is paid for from public funds, no claim for that meal can be made.

- The meal/per diem allowances cover expenses arising from absences away from headquarters or geographic location over a meal period(s).

- Meal expenses incurred within headquarters or geographic location due to job responsibilities, will be reimbursed as follows:

Private Vehicle Allowance

- Where a private vehicle is used on the Employer’s business, reimbursement shall be:Effective April 1, 2019 $0.55 per km

- The distance allowance does not apply when using leased, rental or government vehicles.

- Actual transportation toll charges may also be claimed.

Acceptable Parking Charges

When a private, Government or leased/rental vehicle is used for the Employer’s business, receipted parking charges will be reimbursed.

Commercial Transportation Charges

- Where transportation other than a private vehicle is required, reimbursement will be in accordance with Treasury Board Orders and Directives.

- Where transportation by commercial carrier(s) has been designated as the mode of travel by the Employer and the employee/appointee requests to use his/her private motor vehicle instead and the Employer allows such use, reimbursement will be based on the lesser of the distance allowance for his/her private motor vehicle plus transportation toll charges, if any, for the trip or the designated commercial carrier(s) cost for the trip. No meal, accommodation, travel time or any other expense(s) will be reimbursed beyond the transportation costs that would have occurred had the employee/appointee taken the designated commercial transportation.

Accommodation Charges

- Reimbursement of accommodation expenses will be in accordance with Treasury Board Orders and Directives.

- Where private lodging is used in lieu of commercial accommodation, reimbursement of :$32.28 maximum per day may be claimed.

How do I claim Travel Expenses?

- Download and complete the travel claim form filling in all required areas.

- Proof of Travel: Provide original receipts for required areas as indicated on the claim form.

- Sign and date: after signing and dating the form, upload it to your profile in addition to your claim.

Let's Get Started!